California Competes Tax Credit

The California Competes Tax Credit (CCTC) is an income tax credit available to businesses that want to locate in California or stay and grow in California. Businesses of any industry, size, or location compete for over $180 million available in tax credits by applying in one of the three application periods each year. Applicants will be analyzed based on fourteen different factors of evaluation, including number of full-time jobs being created, amount of investment, and strategic importance to the state or region.

$492M

is allocated to this program for FY23-24

23

pages of instructions are provided for applicants, its not a small application

March 18

is the last day of the three annually recurring application periods

Do You Qualify for The California Competes Tax Credit?

Any business can apply for the California Competes Tax Credit. The credit is available statewide to all industries. However, while there are no geographic or sector-specific restrictions, the purpose of the California Competes Tax Credit is to attract and retain high-value employers in California in industries with high economic multipliers and that provide their employees good wages and benefits.

GO-Biz is required by statute to consider the extent to which the credit will influence the business’s ability, willingness, or both, to create new, full-time jobs in this state that might not otherwise be created in the state by the applicant or any other California business.

California Competes Tax Credit Basics

GO‑Biz Administers the California Competes Program. GO‑Biz leads the state’s economic development activities. Among its functions, GO‑Biz administers the California Competes tax credit program. In administering this tax credit program, GO‑Biz has several responsibilities that include: increasing awareness about the credit among the business community, accepting tax credit applications, evaluating applications, negotiating tax credit agreements, and monitoring agreement compliance for at least five years after the agreements are signed.

Amount of Tax Credits Available Has Increased Annually. Up to $780 million in California Competes awards are available in total between 2013‑14 and 2017‑18—$30 million in year one, $150 million in year two, and $200 million per year in each of the following three years. The Department of Finance (DOF) annually adjusts the amount available to reallocate (1) credits not awarded in a prior year and (2) “recaptured” credits (discussed below). In 2016‑17, for example, DOF allocated $243.4 million to California Competes because $39.9 million in tax credits were not awarded during the prior year and an additional $3.5 million had been recaptured. DOF may also reduce the amount of available California Competes credits under certain circumstances, which have not occurred.

Tax Credit Agreements Individually Negotiated. GO‑Biz negotiates five‑year written tax credit agreements with the highest scoring applicant businesses. For each tax credit agreement, GO‑Biz negotiates the amount of tax credit available to the business in each of the five years and the investment and hiring commitments that the business must meet to claim their credit. These terms are summarized in a milestones exhibit that is appended to each agreement. (See Figure 3 for an example of one such exhibit.) State law also requires the agreements include a minimum job retention period. This is a period—three years in most of the agreements—subsequent to the initial five years of the agreement, during which the business may not reduce employment below the final total employment milestone. (Agreements also include various contractual details—such as reporting requirements and the conditions under which the state may recapture a tax credit. These are standard across most of the agreements.) All of the agreements are publicly available on the GO‑Biz website.

Some Businesses Receive Preferences. Current law provides several preferences for businesses that invest and hire in economically disadvantaged areas, and for small businesses. Businesses that would expand in a high‑unemployment or high‑poverty city or county automatically move on to the second phase of the evaluation process. (These areas have poverty or unemployment rates that are at least 150 percent of the statewide rates.) In addition, one‑quarter of the California Competes tax credits are set aside for small businesses. Current law defines small businesses as having less than $2 million in annual revenues. Throughout the process, GO‑Biz evaluates these small business applications separately from the rest.

Who Gets This Tax Credit

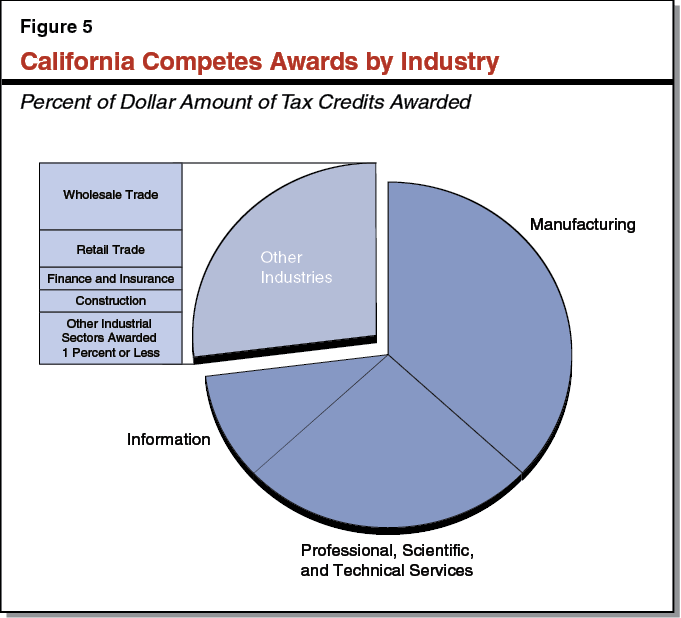

A wide variety of businesses have been awarded California Competes tax credits. The graph to the right here summarizes California Competes awards by industrial sector. The manufacturing sector has received more tax credit awards—261, or more than one‑third of the tax credits by value—than any other industrial sector. The professional, scientific, and technical services sector received about 25 percent of the tax credits by value, and the information sector received about 10 percent. Other key industrial sectors with businesses receiving California Competes tax credits include wholesale trade (9 percent), retail trade (5 percent), finance (3 percent), and construction (3 percent). Within these sectors are businesses that make or distribute products to customers all over the world, as well as businesses that only sell to customers within California.

Small Businesses & California Competes

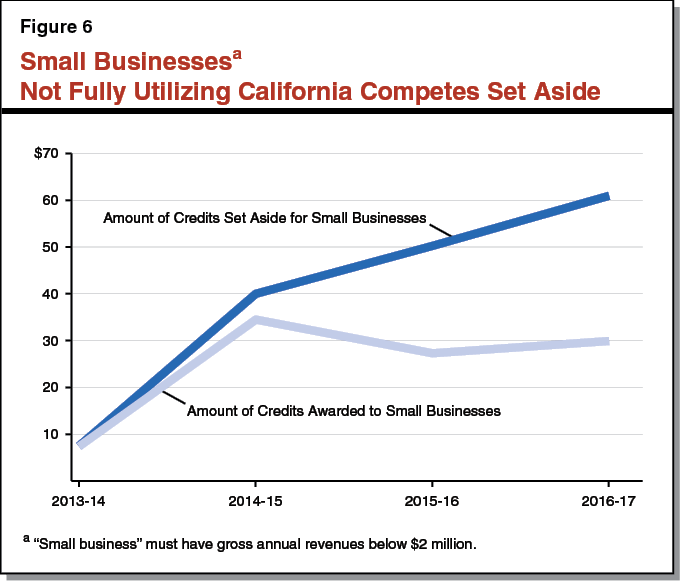

Small Businesses Not Fully Utilizing 25 Percent Set Aside. California Competes reserves one quarter of the tax credits for businesses with gross annual revenues below $2 million. As of June 2017, GO‑Biz has awarded 293 tax credit agreements—amounting to $99 million in total—to small businesses. This amount is about 19 percent of the total $528 million awarded and less than 17 percent of the $590 million that was available. While GO‑Biz sets aside 25 percent of the available tax credits for small businesses, as required, too few qualified businesses have applied to California Competes to utilize all of those credits. Figure 6 shows the amount of tax credits available to small businesses and the amount actually awarded each year. In 2016‑17, GO‑Biz awarded $30 million in tax credits to small businesses—or 49 percent of the amount reserved for them. GO‑Biz has sought to increase the number of small business applicants by increasing their outreach efforts and translating reference material into languages other than English.